How Do I Add Employees To Excel Payroll Template

Payroll in Excel (Table of Contents)

- Introduction to Payroll in Excel

- Instance of Creating a Payroll in Excel

Introduction to Payroll in Excel

- While near organisations turn their heads towards software like Tally or ADP for payroll, or they give a contract to some outsourcing companies to provide them with the payroll services without any fuss. Several reasons are at that place for this approach. However, the core of those is that it is very time-consuming to do all the manual piece of work for payroll and take it gear up. Apart from that, it consumes manpower engaged too. With all the ease information technology makes for them to exist considered, some businesses adopt to do payroll work on their own (in-house) and manage it accordingly.

- Having already said it is a time, cost and manpower consuming task, it provides you total command over your employee's payroll as well as of each penny you lot are spending on them at the same time. In order to do payroll manually, you need something (definitely a tool) that is powerful, versatile and easy to handle at the same fourth dimension. With all these requirements, you tin easily guess the tool. Yes, you lot might accept guessed it right! Microsoft Excel. The range of simple formulae and its simple layout makes excel stand out for those who are doing payroll manually for their employee. In this article, we are going to run into how we can create a payroll manually from scratch.

Example of Creating a Payroll in Excel

Payroll in Excel is very elementary and easy. Permit's understand how to create the Payroll in Excel with a few steps.

Yous can download this Payroll Excel Template here – Payroll Excel Template

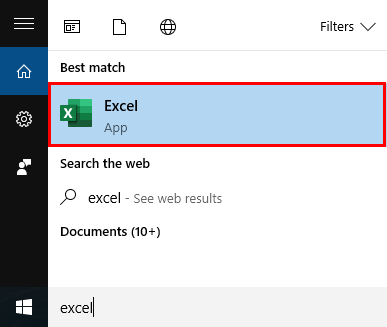

Step one: Open a new blank excel spreadsheet. Become to Search Box. Type "Excel" and double click on the match found nether the search box to open up a blank excel file.

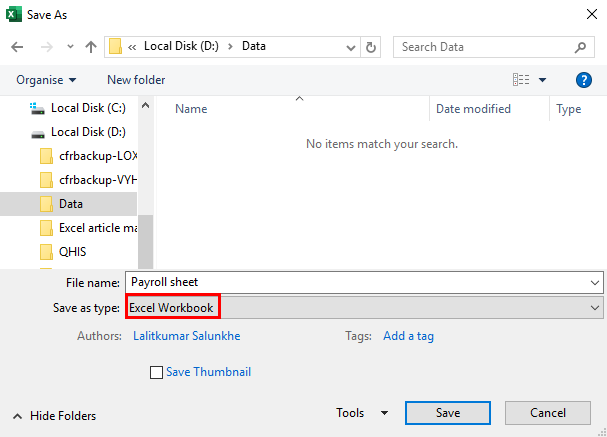

Step ii: Salvage the file on the location yous want your payroll to be saved and then that information technology does not get lost, and you will e'er have information technology with you lot.

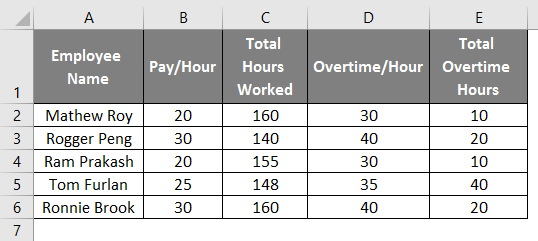

Step iii: In this newly created file where all your employee payroll information would be stored, create some cavalcade with names that can hold the values for certain parameters/variables. Enter the cavalcade names in the following hierarchy.

- Employee Name (column A): Contains your employee name.

- Pay/60 minutes (column B): Contains per hour pay charge per unit to the employee without any currency symbol.

- Total Hours Worked (column C): Contains total hours worked by an employee in a day.

- Overtime/Hour (column D): Overtime charge per unit per hour without any currency symbol.

- Total Overtime Hours (Column E): Number of hours employees overtime in a day.

- Gross Pay (column F): Payable amount to the employee without whatsoever deductibles.

- Income Tax (column G): Tax payable on Gross Pay.

- Other Deductibles (If Any) (column H): Deductibles other than Income Tax.

- Net Pay (column I): Payment, the employee, will receive in hand after all the deductions.

Step four: Add the details column-wise like Employee Name in cavalcade A, the number of hours worked and hourly paying rate, etc. I volition say input the fields with no formula (From column A to cavalcade E). Come across the screenshot below for a ameliorate understanding.

In this instance, if you can run into, the Total Hours Worked and Total Overtime Hours are considered on a monthly basis (because nosotros pay the employee on a monthly ground, correct?). Therefore 160 means total hours worked during the calendar month. The same is the example with total hours overtimed. Also, the Pay/Hr and Overtime/Hour are in USD.

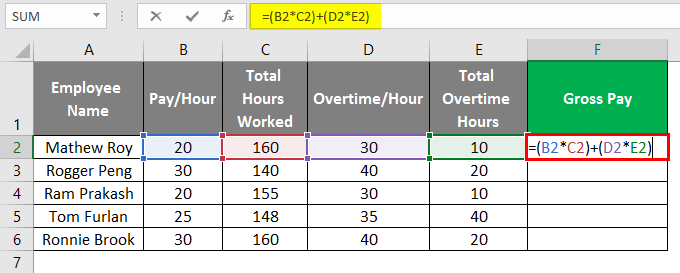

Pace 5: Formulate Gross Pay. Gross Pay is nothing but the sum of the product of Pay/Hour; Total Worked Hours and Overtime/60 minutes, Total Overtime Hours. (Pay/Hr * Total Hours Worked) + (Overtime/Hour * Full Overtime Hours). The payroll canvass tin can exist formulated under jail cell F4 every bit =(B2*C2)+(D2*E2). Information technology'southward a simple formula anyhow. Notwithstanding, you tin can run into the screenshot below for a better understanding.

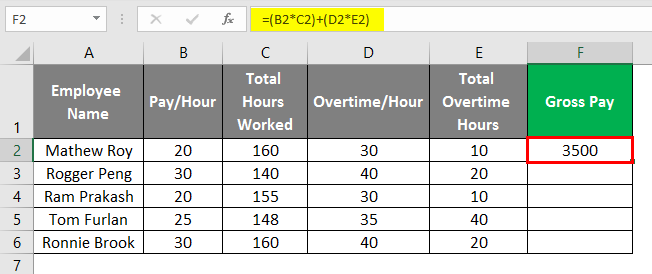

After using the formula, the answer is shown below.

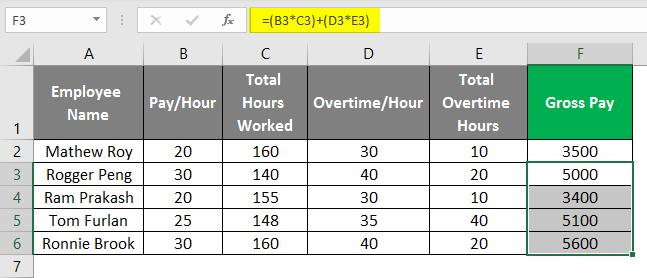

Elevate the same formula prison cell F3 to cell F6.

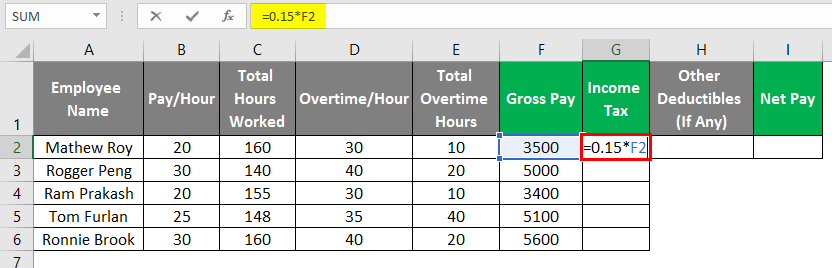

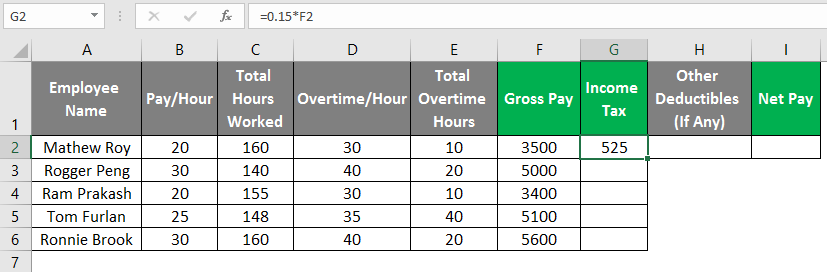

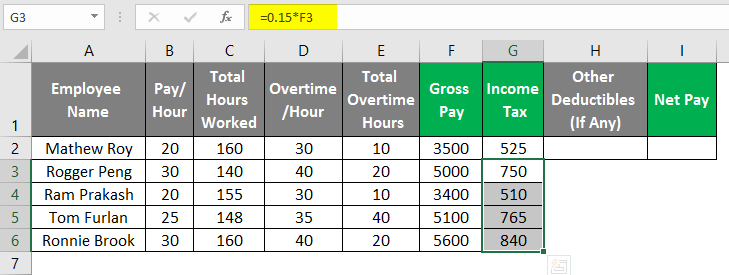

Footstep 6: In order to calculate the Income Revenue enhancement, you demand to check how much pct of tax your employee pays on the full gross pay. Income Revenue enhancement is always calculated on Gross Pay. In this case, nosotros will consider 15% of Income-tax on all the Gross Pay. The formula for Income Tax, therefore, becomes as – 0.xv * Gross Pay.

Which in terms of excel payroll sheet can exist formulated under cell G2 as=0.15*F2 (Column F contains Gross Pay amount).

Drag the aforementioned formula in cell G3 to G6.

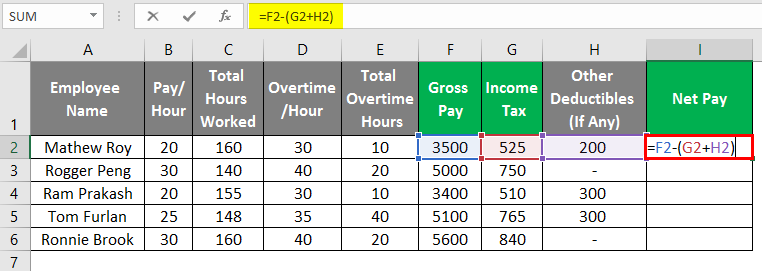

Footstep 7: You have to mention other deductibles, if whatever, for a particular employee. These deductibles may contain the premium of health/life insurance, professional taxes, EMI corporeality if whatever loan is taken from an organization, etc. add together these amount values under column H. If there is no other deductible for a particular employee, you can set up the value nether column H for that employee to nil.

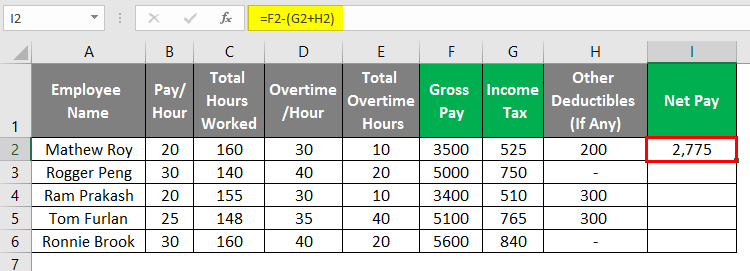

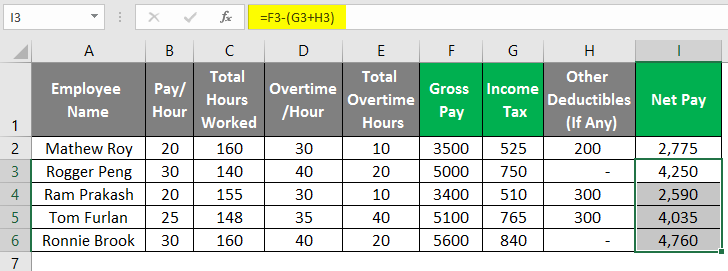

Stride 8: At present, finally, we come up towards Internet Pay. Net Pay is aught just the amount that gets credited into your employee's bank business relationship after all the deductions from Gross Pay. Therefore, in this example, we will deduct (subtract) Income Tax (column One thousand) and Other Deductibles (Column H), which can be formulated under cell I2 every bit =F2-(G2+H2). Here, Income Tax and Other Deductibles are summed upwards and so subtracted from Gross Pay. See the screenshot below for a meliorate understanding.

Drag the same formula in cell I3 to jail cell I6.

This is how we create the payroll under excel to manage things on our own.

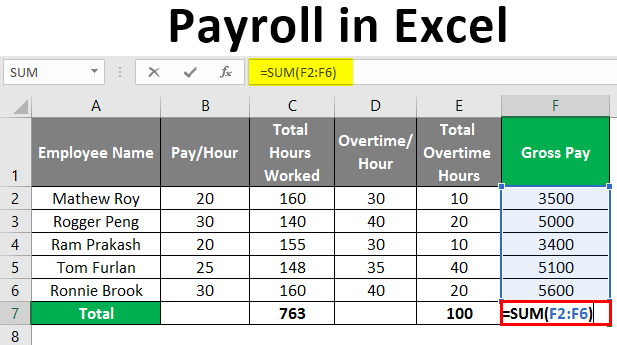

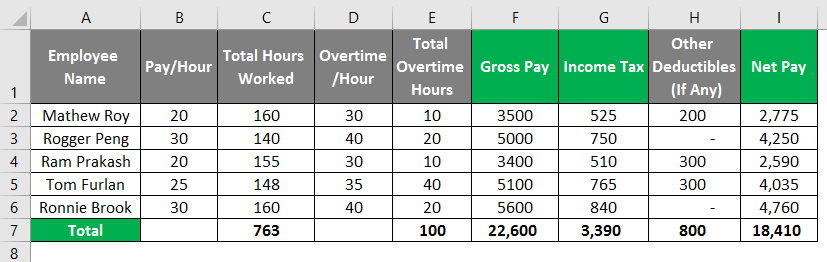

Step 9: Add all the employee names working for you lot in this payroll i by i and prepare their total worked hours, overtimed hours, deductibles and charges accordingly. For Gross Pay, Income Taxation and Internet Pay, just drag the 4thursday cell of respective columns to have the details formulated. Also, add some formatting to the cells and add the total at the terminate of the sheet. The final Payroll should look like this.

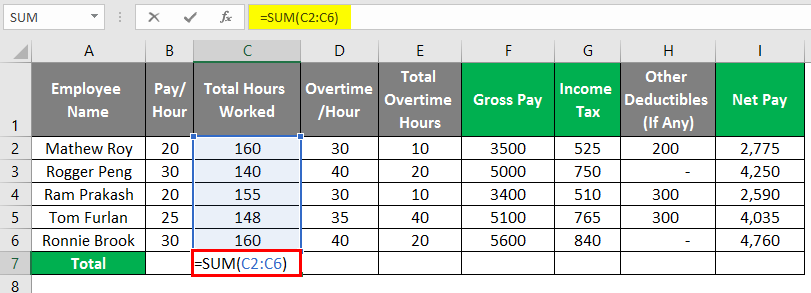

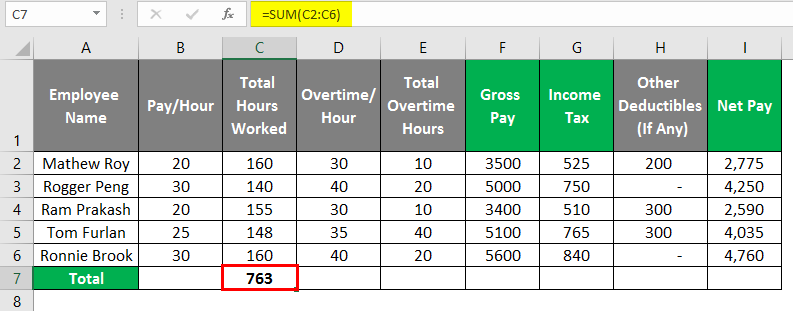

After using the SUM Formula, the answer is shown below.

Discover the Sum Total below.

Things to Remember About Payroll in Excel

- There are more than advanced tools available to take your payroll done. Yet, creating your own in excel gives you a kind of security considering you are monitoring your own payroll there.

- In that location might be some more columns added like health insurance premium, life embrace premium, etc. However, this is a uncomplicated layout.

Recommended Articles

This is a guide to Payroll in Excel. Here nosotros discuss How to Create a Payroll in Excel along with a practical example and downloadable excel template. You tin also get through our other suggested articles –

- MAX Formula in Excel

- Round Formula in Excel

- NPV Formula in Excel

- PPMT Part in Excel

How Do I Add Employees To Excel Payroll Template,

Source: https://www.educba.com/payroll-in-excel/

Posted by: gaertnerlailled.blogspot.com

0 Response to "How Do I Add Employees To Excel Payroll Template"

Post a Comment